SECURITIES AND EXCHANGE COMMISSION

SCHEDULE 14A

(Rule 14a-101)INFORMATION REQUIRED IN PROXY STATEMENT SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

| ☒

| | | | |

| x | Filed by the Registrant |

☐

o | Filed by a Party other than the Registrant |

Check the appropriate box:

☒

Check the appropriate box: |

| o | Preliminary Proxy Statement |

☐

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☐

x | Definitive Proxy Statement |

☐

o | Definitive Additional Materials |

☐

o | Soliciting Material under § 240.14a-12 |

Porch Group, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒

| |

| (Name of Registrant as Specified in its Charter) |

|

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| x | No fee required. |

☐

o | Fee paid previously with preliminary materials. |

☐

o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11 0-11. |

Forward-Looking Statements

Certain statements in this proxy statement, including the letter to stockholders, may be considered “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Although the Company believes that its plans, intentions, and expectations reflected in or suggested by these forward-looking statements are reasonable, the Company cannot assure you that it will achieve or realize these plans, intentions, or expectations. Forward-looking statements are inherently subject to risks, uncertainties, assumptions, and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements including, but not limited to, risks and uncertainties discussed in Part I, Item 1A, “Risk Factors,” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, as well as those discussed in subsequent reports filed with the Securities and Exchange Commission, all of which are available on the SEC’s website at www.sec.gov. Generally, statements that are not historical facts, including statements concerning the Company’s possible or assumed future actions, business strategies, events, or results of operations, are forward-looking statements. These statements may be preceded by, followed by, or include the words “believes,” “estimates,” “expects,” “projects,” “forecasts,” “may,” “will,” “should,” “seeks,” “plans,” “scheduled,” “anticipates,” “intends,” or similar expressions. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by the Company and its management at the time they are made, are inherently uncertain. Nothing in the stockholder letter or proxy statement should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. Unless specifically indicated otherwise, the forward-looking statements in do not reflect the potential impact of any divestitures, mergers, acquisitions, or other business combinations that have not been completed. The Company does not undertake any duty to update these forward-looking statements, whether as a result of changed circumstances, new information, future events, or otherwise, except as may be required by law.

| | | | | | | | |

| |

| | |

| Dear Porch Group Stockholders, | |

| I am thrilled to take this opportunity to express my pride in the accomplishments and dedication of the Porch team over the past year. Our team demonstrated resilience, focus, and delivered strong performance, despite facing numerous market headwinds. We have made good strides in both our insurance and SaaS businesses and are well positioned to win in homeowners insurance through our differentiators.

| |

| | Matt Ehrlichman |

| Chairman, Founder and Chief Executive Officer |

Who We Are

At Porch, we are committed to being the partner for the home, offering a range of products and services designed to protect consumers' most valuable asset and make the move and ongoing maintenance easy. Central to this commitment is our focus on homeowners insurance.

Our strategy for capturing the large and expanding homeowners insurance market revolves around three key differentiators: 1) providing the best services for homebuyers, 2) advantaged underwriting utilizing our unique property data, and 3) protecting the whole home.

Our vertical software products play a crucial role in supporting our insurance strategy by providing us with unique early access to homebuyers and insights about properties. This data enables us to better predict and price risk for homeowners insurance.

2023 Highlights1

Throughout 2023, we executed against various initiatives with a focus on insurance profitability. This included increasing premium per policy, non-renewing higher-risk policies, and improving underwriting, including the use of property insights unique to Porch. Additionally, we had success in our warranty and software businesses, launched new partnerships, and executed cost reductions across our businesses.

We ended the year on a high note. Our financial results for the fourth quarter of 2023 were strong and exceeded expectations: Revenue grew by 79% to $115 million. Revenue less Cost of Revenue increased by 82% to $80 million, and GAAP net loss improved $33 million to $(3) million. Most notably, our Adjusted EBITDA1 profit for the fourth quarter was $12 million, a substantial increase of $25 million compared to the same period in 2022. In every aspect, it was a remarkable quarter for us that sets up an exciting 2024 and future ahead.

For the full year 2023, we achieved Revenue of $430 million, a 56% increase over prior year and Revenue less Cost of Revenue of $210 million, a 25% increase over prior year. GAAP net loss was $(134) million in 2023, a $23 million improvement from prior year. Adjusted EBITDA1 (Loss) was $(45) million, a $5 million improvement over prior year. Most importantly, we surpassed our second-half 2023 profitability goal, achieving Adjusted EBITDA1 of $21 million. Notably, Adjusted EBITDA1 in the second half of 2023 was $45 million better than the second half of 2022. We are proud of the amount of progress we were able to make in just 12 months despite a challenging market environment, including the sharp increase in interest rates over the last couple of years, higher cost of reinsurance and claims, contraction in the real estate market, and historically challenging weather events.

Importantly, we finished a variety of system implementations during 2023 through which we addressed and remediated material weaknesses from 2022, a significant achievement driven by the expertise and leadership of our team. We also released our initial ESG report and we look forward to sharing more in the future.

2024 Outlook

Looking ahead, we are excited about 2024. Our full-year guidance reflects our commitment to sustainable growth and continued profitability improvements. We expect to achieve positive Adjusted EBITDA for the 2024 full year, underpinned by our continued focus on executing our insurance profitability actions, increasing prices in our software businesses, and prudent cost management.

As we reflect on our journey since becoming a public company in December 2020, it's clear that we made significant progress. We’ve delivered strong revenue growth at a 60% 4-year CAGR, from $72 million in 2020 to the $470 million mid-point of our 2024 guidance1. This is driven by our Insurance segment, which reflects the strength of our business model and the dedication of our team. Our 2024 mid-point of Adjusted EBITDA guidance is $5.5 million, a $50 million improvement compared to 2023. We are just getting started.

Closing

I want to express my sincere appreciation to our shareholders for your continued support and confidence in Porch. We believe that we are well-positioned for success, and are excited about the opportunities that lie ahead.

I would like to invite you to participate in our 2024 annual stockholder meeting to be held virtually on Wednesday, June 12, 2024, at 10 a.m. Pacific Time. You will be asked to vote on several items and I encourage you to read the proxy statement prior to the meeting, which includes details on how to attend and cast your votes. This year, among other items, you will be asked to vote on the election of the entire director nominees. This change in practice reflects our continuing commitment to employ best in class governance practices and accountability to our stockholders.

If you have any questions or would like to get in touch regarding anything mentioned in this letter, you may reach us at ir@porch.com.

Onward!

Matt Ehrlichman

Porch Group Chairman, Founder and Chief Executive Officer

April 24, 2024

1. See "Appendix A" of this proxy statement, entitled “Use of Non-GAAP Financial Measures,” for the reconciliation of Adjusted EBITDA (Loss) to net income (loss), which is the most directly comparable measure under GAAP, and Adjusted EBITDA (Loss) as a percentage of Revenue. Porch is not providing reconciliations of forward-looking non-GAAP guidance to the comparable GAAP measures because certain information necessary to calculate such measures on a GAAP basis is unavailable or dependent on the timing of future events outside of Porch’s control. In particular, the charges excluded from these non-GAAP measures are subject to high variability and complexity due to Porch’s ongoing growth.

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS To Be Held on June

8, 202212, 2024

Notice is hereby given that the

2022 Annual Meeting2024 annual meeting of

Stockholdersstockholders (the “Annual Meeting”) of Porch Group, Inc., a Delaware corporation

(“Porch,” or the(the “Company”), will be held on June

8, 2022,12, 2024, at

9:10:00 a.m. Pacific Time as a virtual meeting held entirely over the Internet, to consider the following matters, as more fully described in the enclosed proxy statement:

| ■ | Election of two Class II directors named in this proxy statement until the 2025 Annual Meeting of Stockholders (or until the 2024 Annual Meeting of Stockholders if Proposal 2 is approved and the Declassification Amendment (as defined in this proxy statement) is filed and becomes effective as described in this enclosed proxy statement) and until their successors are duly elected and qualified, subject to their earlier resignation, removal or death; |

| ■ | the approval of an amendment to the Second Amended and Restated Certificate of Incorporation of Porch Group, Inc. (the “Certificate of Incorporation”) to declassify our Board commencing with the 2024 Annual Meeting of Stockholders; |

| ■ | the approval of an amendment to our Certificate of Incorporation to eliminate the Supermajority Voting Standard (as defined in the enclosed proxy statement) commencing with the 2024 Annual Meeting of Stockholders; |

| ■ | the approval of, on an advisory (non-binding) basis, the compensation of our Named Executive Officers (as defined in the enclosed proxy statement); |

| ■ | the approval of, on an advisory (non-binding) basis, the frequency of future advisory votes to approve the compensation of our Named Executive Officers; |

| ■ | to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022; and |

| ■ | to consider and transact other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

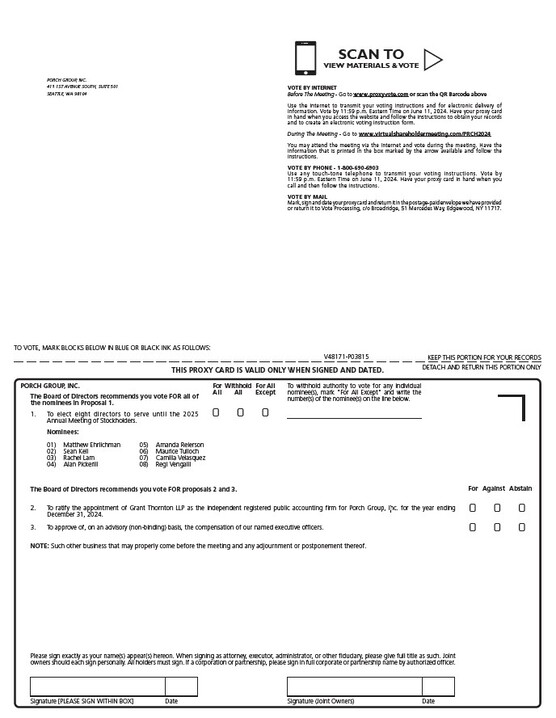

■election of the eight directors named in the enclosed proxy statement, each to serve until the 2025 annual meeting of stockholders and until their successors are duly elected and qualified, subject to their earlier resignation, removal, or other termination of service;

■to ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024;

■the approval of, on an advisory (non-binding) basis, the compensation of our named executive officers; and

■to consider and transact other business as may properly come before the Annual Meeting and any adjournment or postponement thereof.

Stockholders of record at the close of business on April

13, 202215, 2024, are entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponement thereof.

To attend the Annual Meeting,

examine our list of stockholders, vote and submit your questions during the Annual Meeting, go to

www.virtualshareholdermeeting.com/PRCH2022.PRCH2024. A list of stockholders of record will also be available during the Annual Meeting on the meeting website. Prior to the Annual Meeting, you will be able to vote at

www.proxyvote.com and by the other methods described in

thisthe enclosed proxy statement.

To be admitted to the Annual Meeting, please visit www.virtualshareholdermeeting.com/PRCH2022.PRCH2024. You will log into the Annual Meeting by entering your unique 16-digit control number found on your proxy card or voting instructioninstructions form.

| | |

You may cast your vote in advance of the Annual Meeting over the Internet, by telephone or by completing and mailing a proxy card. ReturningVoting in advance of the proxyAnnual Meeting does not deprive you of your right to attend the Annual Meeting and to vote your shares electronically during the Annual Meeting. Proxies forwarded by or for banks, brokers or other nominees should be returned as requested by them. We encourage you to vote promptly to ensure your vote is represented at the Annual Meeting, regardless of whether you plan to attend the Annual Meeting. |

You can find detailed information regarding voting in the section entitled “General Information” on the page immediately following the table"Notice of contents2024 Annual Meeting of Stockholders" of the accompanying proxy statement.

By order of the Board of Directors,

Matthew Cullen

General Counsel and Secretary

Seattle, Washington

April 24, 2024

| | |

| By order of the Board of Directors,

|

|

|

Matthew Cullen

General Counsel and Secretary

Seattle, Washington

April [•], 2022

|

|

[April XX, 2022] at www.proxyvote.com. [Rule 14a-5(e)]

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 8, 2022 12, 2024The notice of the Annual Meeting, proxy statement and the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021,2023, are first being sent and made available to stockholders on or about

April [•], 202224, 2024 at www.proxyvote.com. The date of this proxy statement is April [•], 2022.24, 2024. |

GENERAL INFORMATION

This proxy statement is furnished to stockholders of Porch Group, Inc., a Delaware corporation (the “Company”), in connection with the solicitation of proxies by the board of directors of the Company (the “Board”) for use at our 20222024 Annual Meeting of Stockholders to be held on June 8, 202212, 2024 (the “Annual Meeting”), and at any adjournment or postponement thereof. The Annual Meeting will be held at 9:10:00 a.m. Pacific Time at as a virtual meeting held entirely over the Internet.

The Company was formed upon the closing of the business combination of Porch.com, Inc. (“Legacy Porch”) with PropTech Acquisition Corporation (“PTAC”), a special purpose acquisition company, on December 23, 2020. In connection with such business combination, PTAC changed its name to “Porch Group, Inc.” and Porch Group, Inc.’s common stock commenced trading on the NASDAQ under the ticker “PRCH.”.

As permitted by the rules of the Securities and Exchange Commission (the “SEC”), we are making this proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31,

2021 (Form 10-K)2023 (“Form 10-K”) available to our stockholders electronically via the Internet at

www.proxyvote.com.www.proxyvote.com. We believe that internet delivery of our proxy materials allows us to provide our stockholders with the information they need, while lowering the costs of delivery and reducing the environmental impact of our Annual Meeting. On or about April

[•] 2022,24, 2024, we mailed to our stockholders a Notice of Internet Availability of Proxy Materials (“Internet Notice”), containing instructions on how to access this proxy statement,

Form 10-K, and vote over the Internet or by telephone. If you received an Internet Notice by mail, you will not receive a printed copy of the proxy materials in the mail unless you specifically request them pursuant to the instructions provided in the Internet Notice. The Internet Notice instructs you on how to access and review all of the important information contained in this proxy statement.

The Annual Meeting will be held entirely over the Internet via live video webcast due to the public health impact of the COVID-19 pandemic and to support the health and wellness of our stockholders, directors, team members, and guests. The virtual Annual Meeting will also allow for greater participation by all of our stockholders, regardless of their geographic location. To attend the Annual Meeting, examine our list of stockholders, vote and submit your questions during the Annual Meeting, go to www.virtualshareholdermeeting.com/PRCH2022PRCH2024. Prior to the Annual Meeting, you will be able to vote at www.proxyvote.com and by the other methods described in this proxy statement. We are excited to embraceOur virtual format leverages the latest technology to provide expanded access, improved communication and cost savings for our stockholders.stockholders, while providing our stockholders with the same rights and opportunities as they would have at an in-person meeting.

To be admitted to the Annual Meeting, please visit www.virtualshareholdermeeting.com/PRCH2022PRCH2024. You will log into the Annual Meeting by entering your unique 16-digit control number found on your proxy card or voting instructioninstructions form.

Proxy Statement SummaryGLOSSARY OF TERMS

| | | | | |

| Term | Definition |

| 2012 Stock Plan | Porch.com, Inc. 2012 Equity Incentive Plan |

| 2020 Stock Plan | Porch Group, Inc. 2020 Stock Incentive Plan |

| 2023 Bonus Plan | Senior Level Performance Bonus Plan |

| 2023 LTI Equity Program | Long-term incentive compensation awarded to NEOs in 2023 comprised of RSUs and PRSUs, with PRSUs representing 75% of the award and RSUs representing 25% of the award |

| Absolute Share Price | Absolute share price based upon the closing price of a share of common stock of the Company being equal to or greater than certain specified prices (calculated based upon compound annual growth rates of the VWAP Common Stock Price) over a defined period. |

| Achievement Period | Each year of the performance period for PRSU awards subject to two performance goals |

| Annual Meeting | 2024 Annual Meeting of Stockholders of Porch Group, Inc. |

| Board | Board of Directors of Porch Group, Inc. |

| Business Combination | Business combination of Porch.com with PropTech Acquisition Corporation |

| Bylaws | Amended and Restated Bylaws of Porch Group, Inc. |

| CAGR | Compound Annual Growth Rate |

| CAP | Compensation actually paid |

| CEO Employment Agreement | Employment agreement with Mr. Ehrlichman |

| Certificate of Incorporation | The Third Amended and Restated Certificate of Incorporation dated June 9, 2022 |

| CFO Employment Agreement | Employment agreement with Mr. Tabak |

| Change in Control Termination | Upon a termination of the Executive’s employment by the Company without Cause (and other than by reason of death or Disability), or the Executive’s resignation for Good Reason, in each case within 12 months following a Change in Control |

| CIRP | Cybersecurity Incident Response Plan |

| COO Employment Agreement | Employment agreement with Mr. Neagle |

| Code | The Porch Group, Inc. Code of Business Conduct and Ethics adopted by the Board effective December 23, 2020, amended April 9, 2024 |

| Committees | Standing Committees (i.e., Audit, Compensation, Nominating and Corporate Governance, and Mergers and Acquisitions Committees) of the Board of Directors of Porch Group, Inc. |

| Company | Porch Group, Inc. |

| EBITDA | Earnings before interest, taxes, depreciation, and amortization |

| ESG | Environmental, Social and Governance |

| Exchange Act | Securities Exchange Act of 1934, as amended |

| Executive | Each of Messrs. Ehrlichman, Neagle, and Tabak, for purposes of the "Employment Agreements" section of this proxy statement |

| EY | Ernst & Young LLP, the Company's former independent registered public accounting firm |

| FASB ASC Topic 718 | Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation-Stock Compensation |

| Form 10-K | Annual Report on Form 10-K for the fiscal year ended December 31, 2023 as filed with the SEC |

| GAAP | Generally accepted accounting principles in the United States |

| Grant Thornton | Grant Thornton, LLP the Company's independent registered public accounting firm |

| HOA | Homeowners of America Insurance Company |

| | | | | |

| Internet Notice | Notice of Internet Availability of Proxy Materials |

| IRS Code | Internal Revenue Code of 1986, as amended |

| Legacy Porch | Porch.com, Inc. |

| LTI | Long-term incentive |

| Nasdaq | The Nasdaq Stock Market |

| NEO | Named Executive Officer |

| Non-Change in Control Termination | Termination of the Executive's employment by the Company without Cause (and other than by reason of death or Disability), or his resignation for Good Reason |

| PCAOB | Public Company Accounting Oversight Board |

| PEO | Principal Executive Officer |

| PRSU | Performance-based Restricted Stock Unit |

| RSU | Restricted Stock Unit |

| SaaS | Software-as-a-service |

| SOX | Sarbanes-Oxley Act of 2002 |

| Say on Pay | The opportunity for stockholders to vote (annually) on the Company’s NEO compensation program |

| SEC | U.S. Securities and Exchange Commission |

| Severance Period | Period of 12 months |

| STI | Short-term incentive |

| TSR | Total Shareholder Return |

| TTM Revenue Condition | Trailing twelve-month revenue |

| U.S. | United States |

| Vesttoo | Vesttoo Ltd. |

| VWAP | Volume-weighted average price of a share of common stock of the Company |

| WTW | The Company's independent compensation consultant, formerly Willis Towers Watson |

| |

| |

| |

| |

`

PROXY STATEMENT SUMMARY

| | |

| This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider. Please read carefully the entire proxy statement and Form 10-K before voting. |

About the Annual Meeting

| | | | | | | | | | | | | | | | | |

| Date and Time | Place | Record Date |

|

|

|

| June 8, 2022,12, 2024, at 9:

10:00 a.m. Pacific Time |

| Virtual Meeting Site:

www.virtualshareholdermeeting.com

/PRCH2022PRCH2024

|

| You can vote if you were a stockholder of record as of the close of business on April 13, 2022 15, 2024 |

|

|

|

|

|

|

If you plan to attend the virtual meeting, please be sure to have available your 16-digit control number found on your proxy card or voter instruction form. For beneficial holders who do not have a control number, please contact your broker, bank, or other nominee as soon as possible, so that you can be provided with a control number and gain access to the meeting. If you lost your 16-digit control number or are not a stockholder, you will be able to attend the meeting by visiting

www.virtualshareholdermeeting.com/PRCH2022PRCH2024 and registering as a guest. If you enter the meeting as a guest, you will not be able to vote your shares,

examine oursubmit questions or access the list of stockholders

or submit questionsas of the record date during the meeting.

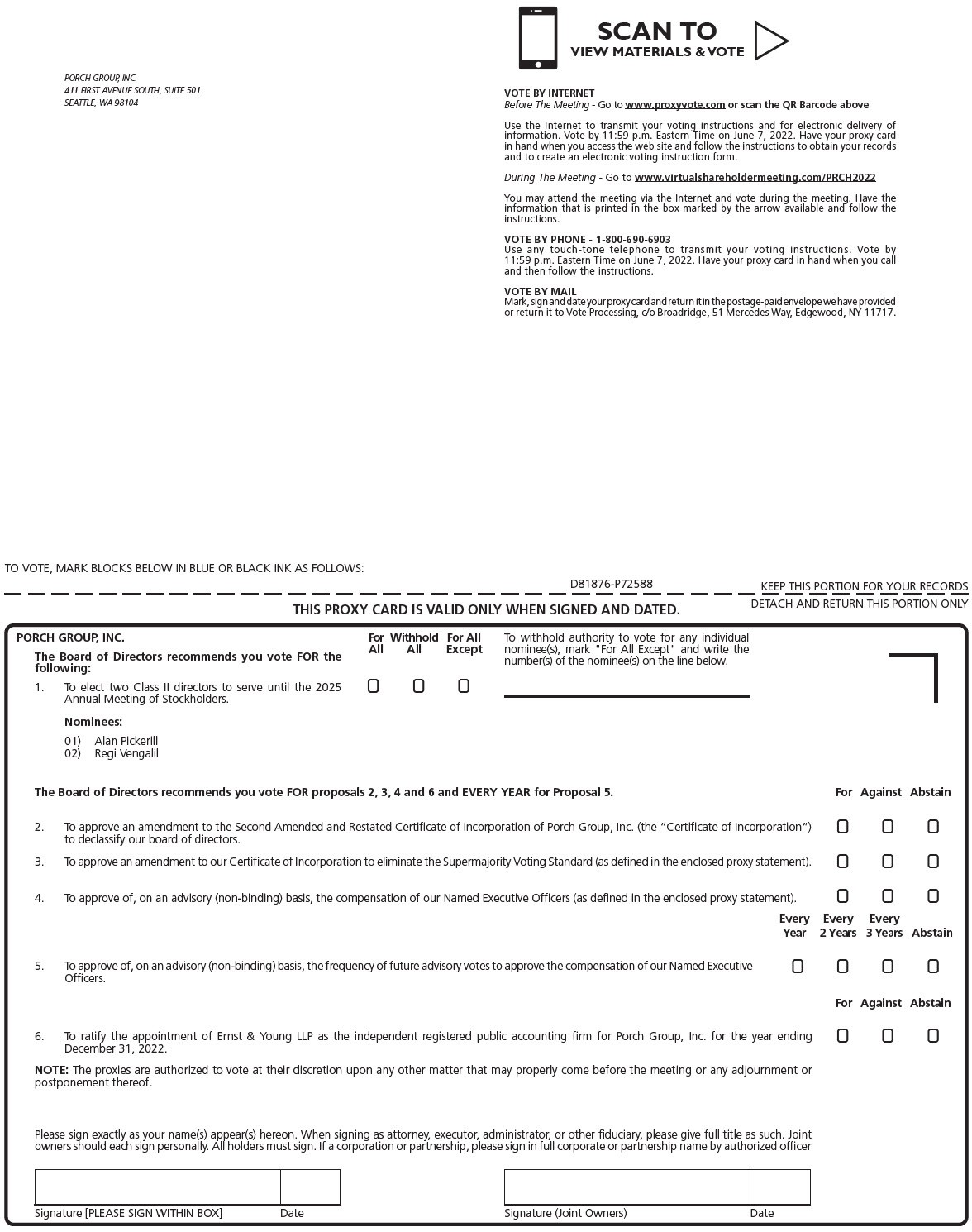

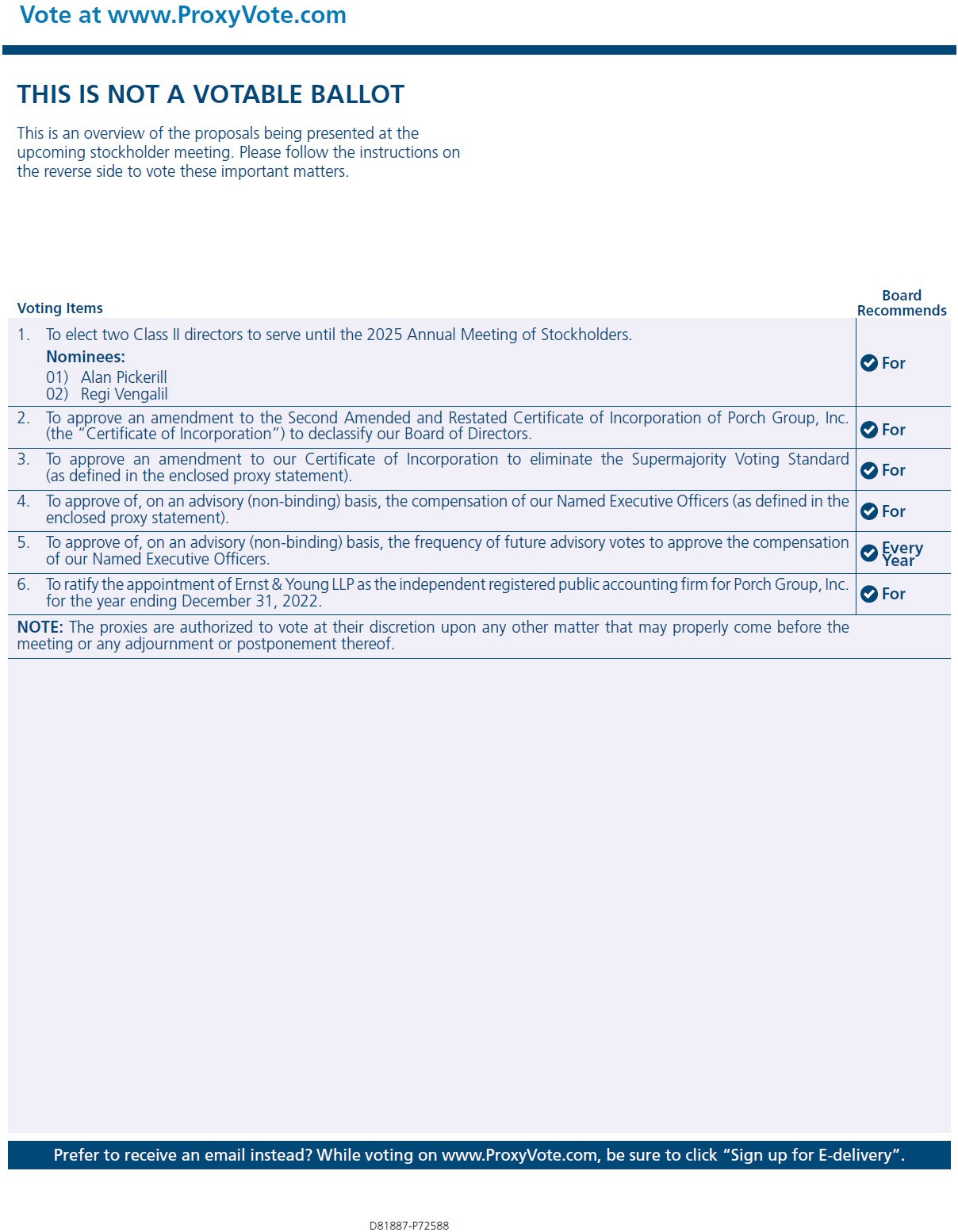

Proposals and Voting Matters and Board Recommendations |

| | | | | | | |

| Board Vote

Recommendation | Page |

Election of the two Class IIeight directors named in this proxy statement, each to serve until the 2025 Annual Meetingannual meeting of Stockholders (or until the 2024 Annual Meeting of Stockholders if Proposal 2 is approved and the Declassification Amendment is filed and becomes effective as described in this proxy statement)stockholders and until their successors are duly elected and qualified, subject to their earlier resignation, removal or death.other termination of service. | FOR

each Director

Nominee | 5

|

| FOR

| 9

|

PROPOSAL 3: AMENDMENT TO COMPANY CERTIFICATE OF INCORPORATION to eliminate supermajority voting standard

Amendment to the Certificate of Incorporation of the Company to eliminate the Supermajority Voting Standard commencing with the 2024 Annual Meeting of Stockholders.

| FOR

| 11

|

PROPOSAL 4: say on pay

Advisory vote to approve Named Executive Officer compensation.

| FOR

| 12

|

PROPOSAL 5: SAY ON FREQUENCY OF PAY

Advisory vote on the frequency of future advisory votes on Named Executive Officer compensation.

| ONE YEAR

| 14

|

PROPOSAL 6: RATIFICATION OF THE APPOINTMENT OF OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Ratification of the appointment of Ernst & YoungGrant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022. | FOR

| 15

|

| FOR | |

ir.porchgroup.com

Advisory (non-binding) vote to approve named executive officer compensation. | 1

FOR | |

If you hold your shares in street name via a broker, bank or other nominee, you may direct your vote without attending the Annual Meeting by signing, dating and mailing your voting instruction card.instructions form. Internet or telephonic voting may also be available. Please see your voting instruction cardinstructions form provided by your broker, bank or other nominee for further details. If you are a holder of record of shares of common stock of the Company, you may direct your vote without attending the Annual Meeting in one of the following ways:

| | | | | | | | | | | |

| | | |

| | | |

|

|

|

|

|

|

|

|

Visit www.proxyvote.com with your proxy card in hand and follow the instructions on the web site. |

Go to www.virtualshareholdermeeting.com

/PRCH2022PRCH2024 and follow the voting instructionsinstructions. |

Call 1-800-690-6903, withhave your control number available and follow the instructions. Your control number can be found on your proxy card in hand and follow the instructions.or voter instruction form. |

Mark, sign and date your proxy card and return it in the postage-paid envelope provided or return it to: Vote Processing c/o Broadridge 51 Mercedes Way, Edgewood NY 11717. |

|

| | |

About Porch Group, Inc.Porch Group is a leading vertical software and insurance platform and is positioned to be the best partner to help homebuyers move, maintain, and fully protect their homes. We offer differentiated products and services, with homeowners insurance at the center of this relationship.

We differentiate and look to win in the massive and growing homeowners insurance opportunity by 1) providing the best services for homebuyers, 2) leading by advantaged underwriting in insurance, 3) protecting the whole home.

As a leader in the home services SaaS space, we’ve built deep relationships with approximately 30 thousand companies that are key to the home-buying transaction, such as home inspectors, mortgage companies, and title companies.

We have grown the utilization of our software across these industries; for example, more than 40% of home inspections in 2023 and approximately 40% of title transactions in 2023 were processed through our software. These relationships provide us with early insights to a significant number of U.S. homebuyers. In partnership with these companies, we have the ability to help simplify the move for consumers with services such as insurance, warranty, moving and more.

Through our vertical software products we have unique insights into the majority of U.S. properties. This data helps feed our insurance underwriting models, better understand risk, and create competitive differentiation in underwriting.

We provide full protection for the home by including a variety of home warranty products alongside homeowners insurance. We are able to fill the gaps of protection for consumers, minimize surprises, and deepen our relationships and value proposition

Summary of Company Financial and Operating Performance

The Porch team delivered a strong performance in 2023, despite the challenges faced. Over the past year there were interest rate increases, higher reinsurance costs, housing market declines, and challenging weather events. The team remained focused and delivered record profitability in the second half of 2023, a milestone for the Company. Other key accomplishments include:

■Improving profitability through insurance profitability actions which focused on increases in premium per policy, non-renewal of higher risk policies and other underwriting actions

■Launching Porch Warranty and new products for software customers, resulting in increased pricing and high customer retention

■Reducing costs across the business while continuing investment in key growth initiatives

| 2

| | | | |

| ir.porchgroup.com | 2022Proxy Statement

9 |

About Us

| | | | | | | | |

| | |

| 2023 Financial and Operating Performance Highlights |

|

| < | Total Revenue of $430.3 million, an increase of 56% from total Revenue of $275.9 million for 2022 |

| < | Revenue less Cost of Revenue of $210.1 million, a 25% increase from $168.4 million for 2022 |

| < | GAAP net loss of $(133.9) million, compared to a GAAP net loss of $(156.6) million for 2022 |

| < | Achieved second half 2023 Adjusted EBITDA1 target of $21 million (~$45 million increase compared to prior year), which benefited from the insurance profitability actions, surpassing the second half 2023 profitability target set two years ago |

| < | Adjusted EBITDA (Loss) 1 of $(44.5) million or (10)% of total Revenue, compared to the Adjusted EBITDA loss1 of $(49.6) million or (18)% of total Revenue for the full year 2022 |

| < | Insurance segment key performance indicators: |

| < | Gross Loss Ratio of 69%, compared to 72% in 2022 |

| < | Gross written premium decreased 2% to $525 million from $536 million in 2022 |

| < | Annualized premium per policy increased 55% to $1,884 from $1,215 in 2022 |

| < | Software and services to companies: |

| < | Average number of companies of 30,476 compared to 29,032 in 2022 |

| < | Average revenue per company per month of $1,184 a 49% increase compared to $794 in 2022 |

| < | Monetized services1 for customers: |

| < | Number of monetized services was 903,455, compared to 1,128,223 in 2022 |

| < | Average revenue per monetized service was $404, an increase from $184 in 2022 |

| < | $398 million(2) of cash, cash equivalents, short-term and long-term investments as of December 31, 2023 |

| < | $34 million positive operating cash flow for 2023 |

| < | Refinanced debt, reducing medium-term maturity by $200 million while raising secured debt at 6.75% coupon |

| < | Launched new products in the SaaS businesses, increased pricing and built new partnerships |

| < | No material weaknesses in 2023, following system implementations and improvements in the control environment |

(1)See "Appendix A" of this proxy statement, entitled “Use of Non-GAAP Financial Measures,” for the reconciliation of Adjusted EBITDA (Loss) to net income (loss), which is the most directly comparable measure under GAAP. See "Appendix B" of this proxy statement, entitled “Use of Key Performance Measures,” for the reconciliation of Average Revenue per Monetized Service.

(2)Of this amount, HOA, Porch's insurance carrier, held cash and cash equivalents of $208 million and investments of $103 million. Excluding HOA, Porch held $87 million of cash, cash equivalents and investments.

WE SIMPLIFY THE HOME JOURNEY

| vision

■

To be the partner for the home.

Mission

■

To make the home simple from moving to improving and everything in between.

Our Shared Values

| | | | |

10 |

|

|

|

2024 Proxy Statement |

OUR COMPENSATION AND GOVERNANCE HIGHLIGHTS

Our NEO Compensation Program, Practices and Policies

| | | | | |

| |

■Stockholders have the opportunity to vote annually on the Company’s NEO compensation program (say-on-pay)■Engage independent compensation consultant ■Ongoing review of our compensation strategy and our compensation-related risk profile ■Change of control double-trigger equity awards generally ■Full prohibition on hedging and pledging of our securities by NEOs ■Adopted clawback policy in-line with the Nasdaq listing standards as a result of SEC rulemaking | ■Continue to mature and enhance our performance-based programs to further incentivize our NEOs to achieve our overall financial and operational objectives and deliver long-term value to our stockholders

■Utilize annual peer group benchmarking, including ongoing review of peer group composition■Stock ownership guidelines for NEOs |

|

|

|

■Prohibit repricing or replacing stock options for NEOs ■No Jerks/No Egos - The journey starts with who you bring alongguaranteed salary increases and the most important person is who you choose to be. Choose each day to set the example in your actions and your attitude. Keep an open mind to feedback and different perspectives. Show kindness and respect to others, especially in conflict. |

| Be Ambitious - Any journey worth taking will push you beyond your sights. Don’t let uncertainty keep you from believing in what is possible. Push yourself to think big, to make every day count and to be optimistic it will be worth it.

|

| Solve Each Problem - Along the way, you will encounter challenges and opportunities and how you respond will forever mark your journey. Look at each as a problem to solve. Be thoughtful in your approach and let data drive your decisions. Learn and adapt as you go and persevere until you solve it.

|

| Care Deeply - While the problems you solve set your path, the magic is in the everyday moments. Go above and beyond to make something right or show someone they matter. Invest in understanding and developing a connection with the people you serve. Take pride in the work you do and make sure it is done well.

|

| Together We Win - At the end of the journey, you will think most about who stood beside you and who you did, or did not help along the way. Fight to win, but fight harder to win together. Focus on the team before yourself. Take ownership and make everyone you bring along betterprovide gross-ups for having been on the journey with you.

|

|

severance payments |

Our Corporate Governance Practices and Policies

Our Governance Highlights

| |

Best Practices in Corporate Governance

|

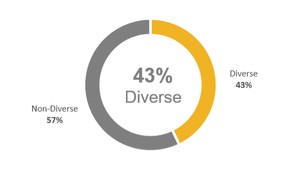

■Fully declassified Board structure effective as of this 2024 annual meeting of stockholders with annual director elections ■ The composition of our Board represents broad perspectives, experiences and knowledge relevant to our businesses, in addition to reflecting gender and ethnic diversity.

■

Established Lead Independent Director;Director with significant responsibilities; elected by Independent Directors.independent directors

■ Meetings comprised onlyProactive achievement of Independent Directors that follow quarterly Board meetings.

■

Review of committee governance atestablishing a business level to assess areas of improvement.

■

Directors may not serve on more than four public company boards in addition to the Company’s Board. Company’s CEO may not serve on more than two.

■

Risk assessment process designed to identify and manage enterprise-wide risks, including risks relating to IT/cybersecurity.

| ■

Nominating and Corporate Governance Committee oversight and review of broader stakeholder perspective using Environmental, Social and Governance (ESG) lens; initiated ESG planning process.

■

Corporate governance guidelines sets forthdiverse Board; Board nominee selection criteria that takes into account diversity and experience, among other criteria.criteria

■Our Board and Committees engage in annual self-evaluations; in 2023, through discussion and directed feedback and engagement with management ■Annual management and board engagement to review board charters and Company policies for legal compliance and best practices; updates recommended by the Board committees and approved by the Board | Implemented director■Director resignation policy, including for conflicts of interest, over-boarding policy and a “plurality-plus” voting standard in uncontested elections.elections

■Enterprise risk assessment process designed to identify and mitigate key risks, including those related to financial systems, SOX compliance, cybersecurity, information systems, and data■Adopted clawback policy in-line with the Nasdaq listing standards as a result of SEC rule making ■Full prohibition on hedging and pledging of our securities by directors, NEOs, and employees Proposal, unanimously approved by Board,■Enhanced controls and procedures for cybersecurity risk management and incident response to declassify board structure.comply with new SEC disclosure requirements

■ Proposal, unanimously approved by Board, to eliminate supermajority voting requirement to amend certain provisions of Certificate of Incorporation.

■

Proposal, unanimously approved by Board, to hold an annual say-on-pay vote.

|

Our Compensation Highlights

| |

WHAT WE DO

| WHAT WE DO NOT DO

|

✓

Utilize peer group benchmarking

✓

Engage independent compensation consultant

✓

Stock ownership guidelines for Directorsapplicable to executive officers and NEOsdirectors ■Established enhanced internal control procedures to strengthen our internal control over financial reporting and address previously identified material weaknesses; remediated all previously identified material weaknesses over internal control over financial reporting as of December 31, 2023 |

✓

On-going review of our compensation strategy, including a review of our compensation-related risk profile

✓

Change of control double-trigger equity awards generally

✓

Design compensation to align our executive compensation with long-term shareholder interests

✓

Link long-term incentive compensation to publicly available performance metrics to motivate strong performance

| | | | | |

| ir.porchgroup.com | ✘ Permit hedging and pledging by executives

✘ Offer executive perquisites

✘ Reprice or replace stock options

✘ Provide defined benefit, supplemental executive retirement or nonqualified deferred compensation plans

✘ Provide gross-ups for severance payments

✘ Guarantee salary increases

11 |

PROPOSAL 1: ELECTION OF THE CLASS II DIRECTORS NAMED IN THIS PROXY STATEMENT

In 2022, our stockholders approved changes to our Certificate of Incorporation to declassify our Board and move to one-year terms, with such transition period ending in 2024. Our

Board currently consistscurrent term of

sevenoffice for our Class I, Class II and Class III directors

which are divided into three classesexpires at this Annual Meeting, with

staggered, three-year terms.Atthe result being that, beginning with the Annual Meeting and at each subsequent annual meeting of stockholders, all of our stockholders will elect two Class II directors whoseare nominated for election for terms willthat expire annually. Upon recommendation by the Nominating and Corporate Governance Committee, the Board proposes that each director named in this proxy statement be elected for a new one-year term expiring at the Annual Meeting of Stockholders to be held in 2025. Each of our other current directors will continue to serve as a director2025 annual meeting and until the electiontheir respective successors are duly elected and qualification of his or her successor, or until his or her earlier death, resignation or removal.

Our board of directorsqualified.

The Board nominated Matthew Ehrlichman, Sean Kell, Rachel Lam, Alan Pickerill, Amanda Reierson, Maurice Tulloch, Camilla Velasquez and Regi Vengalil for election to our board of directors as Class II directorsthe Board at the Annual Meeting. Each of Messrs. Pickerill and Vengalilthe director nominees currently serves on our board of directors andthe Board, has consented to bebeing named in this proxy statement and agreed to serve, if elected, untilelected. If any of them becomes unavailable to serve as a director, the 2025 Annual Meeting of Stockholders. Each of Messrs. PickerillBoard may designate a substitute nominee. In that case, the persons named as proxies will vote for the substitute nominee designated by the Board.

Information regarding the director nominees, including the qualifications, attributes and

Vengalil, if elected, will hold office until his successor has been duly elected and qualified or until his earlier resignation or removal.If Proposal 2 is approved, the Class II directors elected pursuantskills that led our Board to this Proposal 1 will serve two-year terms expiring at the 2024 Annual Meeting of Stockholders. If Proposal 2 is not approved, our board of directors will remain classified and the Class II directors elected pursuant to this Proposal 1 will serve three-year terms expiring at the 2025 Annual Meeting of Stockholders.

nominate each as a director, can be found below under “Board Nominees.”

There are no family relationships between or among any of our executive officers or director nominees.

Vote Required

The eight nominees

receiving the highest number of votes "FOR" their election will be elected as directors; however, any director nominee who receives more “WITHHOLD” votes than “FOR” votes will tender his or

continuing directors.her resignation to the Board promptly following certification of the stockholder vote. See "Corporate Governance, Structure and Responsibility—Plurality Plus Voting for Directors; Director Resignation Policy" for more information. Brokers do not have discretion to vote on this proposal. Withhold votes and broker non-votes are not treated as votes cast and, therefore, will have no effect on this proposal. Holders of proxies solicited by this proxy statement will vote the proxies received by them as directed on the proxy card or, if no direction is given, then "FOR" the election of each of the director nominees named in this proxy statement.

Recommendation of The Board

| | | | | | | | |

| | |

| | THE BOARD UNANIMOUSLY RECOMMENDS THAT OUR STOCKHOLDERS VOTE “FOR” THE ELECTION OF EACH OF THE BOARD NOMINEES NAMED ABOVE. |

| | |

OUR BOARD NOMINEES

Board Nominees and Continuing DirectorsThe following table sets forth information with respect to our director nominees for election at the Annual Meeting and continuing directors as of April 13, 2022:

| Name

| | | | |

| |

| |

Matthew Ehrlichman

Age: 44

Director since 2020 | Age

| | Director Since

| | Occupation

|

| Class II - Nominees |

Matthew Ehrlichman is the Founder, Chief Executive Officer and Chairman of the Company. Prior to founding Legacy Porch in 2011, Mr. Ehrlichman was Chief Strategy Officer at Active Network. Mr. Ehrlichman joined Active Network in 2007 and helped grow its revenues from $65 million in 2006 to $420 million and an IPO in 2011. Before joining Active Network, Mr. Ehrlichman was Co-Founder and Chief Executive Officer at Thriva, which was acquired by Active Network in March 2007 for Electionapproximately $60 million in cash and stock. Mr. Ehrlichman built Thriva out of his dorm room at this year’s Annual Meeting |

Alan Pickerill

Independent Director

| 55

| | December 2020

| | Former EVP, CFO, Expedia Group, Inc.

|

Regi Vengalil

Independent Director

| 39

| | December 2020

| | CFO, Metromile, Inc.

|

Class III - Nominees for Election atStanford University, where he received his B.S. in Entrepreneurial Engineering and M.S. in Management Science and Engineering. In 2014, Mr. Ehrlichman was named USA TODAY’s Inaugural Entrepreneur of the 2023 Annual Meeting

|

MattYear. Mr. Ehrlichman

Founder, CEO and Chairman

| 42

| | December 2020

| | Founder, Chairman and CEO

is currently the largest single owner of Porch Group, Inc.

Mr. Ehrlichman is qualified to serve as a director due to his significant leadership since the founding of Legacy Porch in 2011 and throughout our journey as a new public company, as well as his ongoing contributions to our long-term strategy and criticality to our current and future business, and his extensive business experience in the home and technology industries. |

| Asha Sharma

Independent |

| | | | | |

| |

| |

| |

Sean Kell Age: 55 Director since 2022 | 33

|

| December 2020

|

| COO, Maplebear Inc. (d/b/a Instacart)

|

| Maurice Tulloch

Independent Director

| 53

| August 2021

| | Former Group CEO, Aviva plc

|

Class I - NomineesSean Kell was appointed as a director in March 2022 and is the Chief Executive Officer for ElectionMD2 an innovative medical concierge service. Formerly, he served as the Chief Executive Officer at the 2024 Annual Meeting

|

Sean Kell

| 53

| | March 2022

| | CEO, Blue Nile, Inc.

from 2019 until March 2023. He was charged with driving the Blue Nile strategic vision and elevating the company’s modern approach to purchasing handcrafted diamond rings and exquisite jewelry online. From 2011 to 2019, Mr. Kell served as Chief Executive Officer of A Place for Mom, a senior living marketplace, where he was responsible for overall brand management and business expansion. Mr. Kell has a proven track record of building successful businesses in e-commerce, digital innovation and product management across leading online retail organizations including Expedia, Hotels.com and Starbucks. He has also previously held various roles at McKinsey and IBM. Mr. Kell holds a M.B.A. from the University of Chicago and a B.S. in Electrical Engineering from the University of Southern California. Mr. Kell is well qualified to serve as a director due to his significant experience working with companies that are implementing rapid technological changes, brand development and business expansion. |

|

| | | | | |

| |

| |

Rachel Lam Director since 2021 | |

| ir.porchgroup.com

| 5

Independent Director

| | | | | |

Rachel Lam Independent Director

| 54

| | has served as a director since August 2021 | | and is the Co-Founder and Managing Partner

of Imagination Capital, an early-stage venture capital firm founded in 2017. From 2003 to 2017, Ms. Lam served as Senior Vice President and Group Managing Director of the Time Warner Investments Group, the strategic investing arm of Time Warner Inc. She managed Time Warner's investments in numerous digital media companies and served on the board of privately held Maker Studios and Bluefin Labs prior to their sales to the Walt Disney Company and Twitter, respectively. Ms. Lam has previously served on 20 boards of directors over the years and currently serves on the board of Magnite (Nasdaq: MGNI), the world’s large independent sell-side ad platform. She also spent several years in investment banking within the M&A group at Morgan Stanley and the Media and Telecommunications group at Credit Suisse. Ms. Lam received a B.S. in industrial engineering and operations research from U.C. Berkeley in 1989 and an M.B.A. from Harvard Business School in 1994. Ms. Lam is well qualified to serve as a director due to her extensive experience serving on both private and public company boards, along with her financial, M&A and strategy experience. |

|

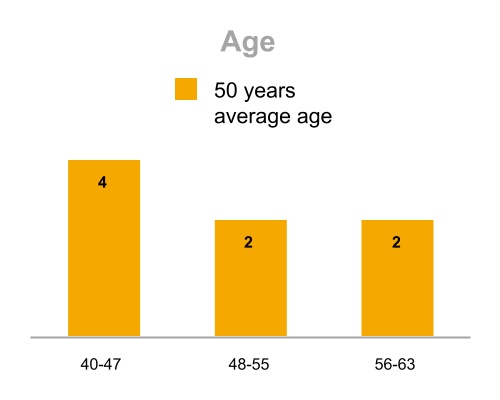

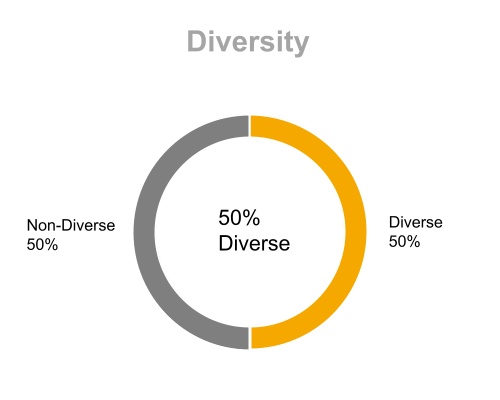

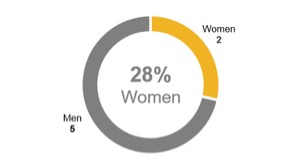

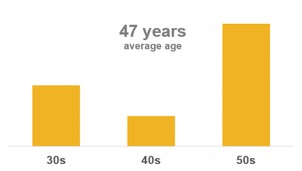

Board Diversity

| | | | | |

| |

| |

Alan Pickerill Director since 2020 | | |

| Gender

| Age

Diversity

|

|

|

|

Board Diversity Matrix (as of April 13, 2022)

Total Number of Directors | 7 |

| Female | | Male | | Non-Binary | | Did Not Disclose

Gender | |

Part I: Gender Identity |

Directors | | 2 | | 5 | | - | | - | |

Part II: Demographic Background |

African American or Black | | - | | - | | | | | |

Alaskan Native or Native American | | - | | - | | | | | |

Asian | | 2 | | 1 | | | | | |

Hispanic or Latinx | | - | | - | | | | | |

Native Hawaiian or Pacific Islander | | - | | - | | | | | |

White | | - | | 4 | | | | | |

Two or More Races or Ethnicities | | - | | - | | | | | |

LGBTQ+ | | - | | - | | | | | |

Did Not Disclose Demographic Background | | | | - | | | | | |

Additional biographical descriptions of the nominees and continuing directors are set forth in the text below. These descriptions include the experience, qualifications, qualities and skills that led to the conclusion that each director should serve as a member of our Board at this time.

Board Nominees — Class II Directors

| |

|

|

Alan Pickerill

| Director since 2020

|

|

|

Alan Pickerill has served as a director since December 2020. Mr. Pickerill has served in a variety of finance and accounting roles, mainly for publicly tradedpublicly-traded technology companies. Most recently he served as Expedia Group’s Executive Vice President, Chief Financial Officer and Treasurer from September 2017 to December 2019 and had been with the Company since 2008. Mr. Pickerill oversaw Expedia Group’s accounting, financial reporting and analysis, investor relations, treasury, internal audit, tax and global real estate teams. Previously, he served as Expedia Group’s Senior Vice President of Investor Relations and Treasurer from July 2015 to September 2017. Mr. Pickerill was a director of Legacy Porch from September 2019 until the completion of the December 2020 business combination that created Porch Group, Inc. He currently serves as a directorchair of the board for Leafly Holdings, Inc. (NASDAQ:(Nasdaq: LFLY), a director for Manson Construction (a privately held marine construction company), a director for the YMCA of Greater Seattle and as adjunct faculty for the University of Washington Foster School Executive MBA program. Mr. Pickerill began his career as an accountant for seven (7) years at Deloitte and Touche before working at a variety of publicly tradedpublicly-traded technology and internet companies, including serving as CFOChief Financial Officer of INTERLINQ Software Corporation, a publicly tradedpublicly-traded technology provider, as well as roles at Microsoft and Getty Images. Mr. Pickerill was licensed as a certified public accountant in Washington in 1991. Mr. Pickerill holds a B.A. degree in Business and Accounting from the University of Washington’s Michael G. Foster School of Business. Mr. Pickerill is well qualified to serve as a director due to his extensive experience in finance-related leadership and governance roles in a publicpublic-held technology company. |

|

| | | | | |

| |

| |

Amanda Reierson Director since 2022 | |

|

|

| Amanda Reierson was appointed as a director in October 2022. She is a marketing veteran with over two decades of experience, including significant management experience in home services and property and casualty insurance. Ms. Reierson served as Chief Marketing Officer at Avant, a financial technology company that provides access to innovative financial solutions, including personal loans and credit cards, and is focused on reaching consumers wherever they may be on their financial journey. Prior to joining Avant, Ms. Reierson served as Head of Marketing at Sequoia-backed Thumbtack, overseeing all branding/creative efforts, media, CRM, and product marketing. Ms. Reierson was also previously Chief Growth Officer at Farmers Insurance, where she led the company's digital marketing and product transformation. Throughout her career she has also served in a variety of B2C and B2B marketing roles at Yahoo, DIRECTV, and the Los Angeles Times. She received her B.A. in Political Science from the University of California, Los Angeles. |

| |

| | | | | |

| |

| |

Maurice Tulloch Age: 55 Director since 2021 | |

| |

| Maurice Tulloch has served as a director since August 2021. From March 2019 until his retirement in July 2020, Mr. Tulloch was Group Chief Executive Officer at Aviva plc, a leading multinational insurance company headquartered in London. He joined the Board of Aviva as an Executive Director in June 2017. In his role at Aviva, he oversaw global leadership, operations, strategy, risk management and governance. In addition, from 1992 until 2019, Mr. Tulloch held many executive and leadership roles at Aviva prior to serving as its Group Chief Executive Officer. On March 4, 2022, Mr. Tulloch joined the Public Sector Pension Investment Board (PSP). Mr. Tulloch has also served on several external boards including PoolRe and as Chair of ClimateWise. Mr. Tulloch received a B.A. in economics from the University of Waterloo in 1992, an M.B.A. from Heriot-Watt University in 2002, and is a Chartered Professional Accountant CPA, CMA since 1998. Mr. Tulloch is well qualified to serve as director due to his extensive operational, strategic, risk management and corporate governance experience, as well as executive leadership in the insurance industry. The Board also determined that Mr. Tulloch is an “Audit Committee financial expert” as defined by the applicable SEC rules. |

|

| | | | | |

| |

| |

| |

Camilla Velasquez Age: 42 Director since 2022 | |

| |

| Camilla Velasquez was appointed as a director in October 2022. She is an accomplished senior product and growth leader who currently serves as the Senior Vice President and General Manager of New York Times Cooking. Prior, Ms. Velasquez worked as Senior Vice President of Product and Strategy at Justworks, the fastest growing HR and benefits technology company, which provides businesses and their employees with the SaaS tools and insurances they need to grow. Justworks also provides consumer-facing products and services. Throughout her career, Ms. Velasquez also held roles including Director of Payment Products and Multichannel Sales at Etsy and Director of New Product Development at American Express. In addition to her corporate experience, Ms. Velasquez serves as the board Chair for Young New Yorkers, an arts-based, youth diversion program focused on criminal justice reform. She holds a B.A. in Economics and in Spanish from Cornell University. Ms. Velasquez is well qualified to serve as director due to her significant strategic and product development experience, as well as her growth and executive leadership. |

|

| | | | | |

| |

| |

Regi Vengalil | Age: 41 Director since 2020 | |

|

|

Regi Vengalil has served as a director since December 2020. Mr. Vengalil ishas been the Chief Financial Officer of Trax Retail, Inc, a private software company in the retail sector since August 2022. Prior to Trax, he was the Chief Financial Officer of Metromile, Inc. (NASDAQ:(Nasdaq: MILE, MILEW), a publicly-traded technology-driven auto insurer. He joined Metromile ininsurer from May 2021 after servinguntil the company’s sale to Lemonade in July 2022. Previously Mr. Vengalil served as Chief Financial Officer of Egencia, the corporate travel division of Expedia Group, from November 2019 to April 2021. Previously, Mr. Vengalil served as2021 and Global Head of Corporate Development & Strategy for Expedia Group from January 2017 to November 2019. Prior to that, Mr. Vengalil was an executive at Lending Club, an online lending marketplace, serving as Vice President, Strategy, M&A and Business Operations from May 2016 until January 2017. Previously Mr. Vengalil served as Vice President, Head of Strategy and Business Operations of Lending Club from November 2015 to May 2016 and Senior Director, Head of Corporate Strategy from October 2014 to November 2015. Mr. Vengalil holds a B.S. in Economics and an M.B.A., both earned with honors, from the Wharton School at the University of Pennsylvania. Mr. Vengalil is well qualified to serve as a director due to his extensive experience in M&A leadership at publicpublicly-traded technology companies and financial, M&A and strategy experience across regions, industries and functions, (includingincluding most recently with regard to insurance businesses). businesses. |

|

Continuing Class III Directors

Director Nominee Skills and Experience

| | | | | | | | | | | | | | |

|

|

Matt Ehrlichman

| Director since 2020

|

|

|

Matt Ehrlichman is the Founder, Chief Executive Officer Our directors exhibit broad perspectives, experiences,

and Chairman for the Company. Priorknowledge relevant to founding Legacy Porch in 2011, Mr. Ehrlichman was Chief Strategy Officer at Active Network, responsible for approximately 85% of the company’s P&L. Mr. Ehrlichman joined Active Network in 2007 and helped grow its revenues from $65 million in 2006 to $420 million and an IPO in 2011. Before joining Active Network, Mr. Ehrlichman was co-founder and Chief Executive Officer at Thriva, which was acquired by Active Network in March 2007 for approximately $60 million in cash and stock. Mr. Ehrlichman built Thriva out of his dorm room at Stanford University, where he received his B.S. in Entrepreneurial Engineering and M.S. in Management Science and Engineering. In 2014, Mr. Ehrlichman was named USA TODAY’s Inaugural Entrepreneur of the Year. Mr. Ehrlichman is qualified to serve as a director due to his extensive leadership and business experience in the home and technology industries.

|

|

| |

|

|

Asha Sharma

| Director since 2020

|

|

|

Asha Sharma has served as a director since December 2020. Ms. Sharma is a senior business executive and currently the Chief Operating Officer of Instacart, which is North America’s largest third-party provider of online grocery stores. In this role, Ms. Sharma oversees the Instacart Marketplace, which includes the Instacart app, and Instacart logistics, growth and marketing, as well as focuses on engaging new and current customers. Before joining Instacart in February 2021, Ms. Sharma was Vice President of Product for Messenger at Facebook Inc. (NASDAQ: FB) from August 2017 to February 2021, a service used globally by more than 1.3 billion people and over 40 millionour businesses, in 190+ countries. As part of Ms. Sharma’s role, she was responsible for Messenger and Instagram Direct user engagement, revenue, privacy, and integrity. Prior to Messenger, Ms. Sharma led the Facebook Inc. Social Impact product teams including charitable giving, crisis response, health, AMBER alerts, and mentorship. As both an entrepreneur and executive, Ms. Sharma brings years of experience building, growing and transforming businesses, with deep focus in consumer product and online marketplaces. Before Facebook Inc., Ms. Sharma was the Chief Operating Officer and early team member of Legacy Porch. Ms. Sharma served as Chief Marketing officer of Legacy Porch from May 2013 to July 2015. Prior to that, Ms. Sharma started her career by founding two companies, one of which was recognized by the President of the United States in 2012. She graduated top of her class at University of Minnesota’s Carlson School of Management. Ms. Sharma is currently on the board of AppLovin Corporation (NASDAQ: APP) a leading marketing platform. Ms. Sharma is well qualified to serve as director due to her prior experience with the Company, her executive operations experience and product leadership.

|

|

| |

|

|

Maurice Tulloch

| Director since 2021

|

|

|

Maurice Tulloch has served as a director since August 2021. From March 2019 until his retirement in July 2020, Mr. Tulloch was Group Chief Executive Officer at Aviva plc, a leading multinational insurance company headquartered in London. He joined the Board of Aviva as an Executive Director in June 2017. In his role at Aviva, he oversaw global leadership, operations, strategy,

financial systems, risk management and governance. In addition, from 1992 until 2019, Mr. Tulloch held many executive and leadership roles at Aviva prior to serving as its Group Chief Executive Officer. On March 4, 2022, Mr. Tulloch joined the board of the Public Sector Pension Investment Board (PSP). Mr. Tulloch has also served on several external boards including PoolRe and as Chair of ClimateWise. Mr. Tulloch received a B.A. in economics from University of Waterloo in 1992, an M.B.A. from Heriot-Watt University in 2002, and is a Chartered Professional Accountant CPA, CMA since 1998. Mr. Tulloch is well qualified to serve as director due to extensive operational, strategic, risk management and corporate governance experience, as well as executive leadership in the insurance industry.

long-term strategy |

|

| | | |

| | | | |

| | | | |

Continuing Class I Directors

Board Diversity

Represents gender and demographic diversity.

Board Diversity Matrix

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of April 24, 2024 | As of April 28, 2023 |

| Total Number of Directors | 8 | | | | 8 | | | |

| Female | Male | Non-Binary | Did Not Disclose

Gender | Female | Male | Non-Binary | Did Not Disclose

Gender |

| Part I: Gender Identity | | | | | | | | |

| Directors | 3 | 5 | - | - | 3 | 5 | - | - |

| Part II: Demographic Background | | | | | | | | |

| African American or Black | - | - | - | - | - | - | - | - |

| Alaskan Native or Native American | - | - | - | - | - | - | - | - |

| Asian | 1 | 1 | - | - | 1 | 1 | - | - |

| Hispanic or Latinx | 1 | - | - | - | 1 | - | - | - |

| Native Hawaiian or Pacific Islander | - | - | - | - | - | - | - | - |

| White | 1 | 4 | - | - | 1 | 4 | - | - |

| Two or More Races or Ethnicities | - | - | - | - | - | - | - | - |

| LGBTQ+ | - | - |

| Did Not Disclose Demographic Background | - | - |

| | | | | |

| 18 | |

|

|

Sean Kell

| Director since 2022

|

|

|

Sean Kell was appointed as a director in March 2022 and is the Chief Executive Officer at Blue Nile, Inc., serving in that role since 2019. He is charged with driving the Blue Nile strategic vision and elevating the company’s modern approach to purchasing handcrafted diamond rings and exquisite jewelry online. From 2011 to 2019, Mr. Kell served as Chief Executive Officer of A Place for Mom, a senior living marketplace, where he was responsible for overall brand management and business expansion. Mr. Kell has a proven track record of building successful businesses in ecommerce, digital innovation and product management across leading online retail organizations including Expedia, Hotels.com and Starbucks. He has also previously held various roles at McKinsey and IBM. Mr. Kell holds a Master of Business Administration from the University of Chicago and a Bachelor of Science in Electrical Engineering from the University of Southern California. Mr. Kell is well qualified to serve as a director due to his significant experience working with companies that are implementing rapid technological changes, brand development and business expansion.

|

|

CORPORATE GOVERNANCE, STRUCTURE AND RESPONSIBILITY

| |

|

|

Rachel Lam

| Director since 2021

|

|

|

Rachel Lam has served as a director since August 2021 and is the Co-Founder and Managing Partner of Imagination Capital, an early-stage venture capital firm founded in 2017. From 2003 to 2017, Ms. Lam served as Senior Vice President and Group Managing Director of the Time Warner Investments Group, the strategic investing arm of Time Warner Inc. She managed Time Warner's investments in numerous digital media companies and served on the Board of privately held Maker Studios and Bluefin Labs prior to their sales to the Walt Disney Company and Twitter, respectively. Ms. Lam has previously served on 20 boards of directors over the years and currently serves on the board of Magnite (NASDAQ: MGNI), the leading, independent omni-channel sell-side software platform, empowering programmatic ad salesDeclassified Board (fully declassified effective at a truly global scale, and Innovid Corp. (NYSE: CTV), an independent CTV advertising and measurement platform for the world’s largest brands. She also spent several years in investment banking within the M&A group at Morgan Stanley and the Media and Telecommunications group at Credit Suisse. Ms. Lam received a B.S. in industrial engineering and operations research from U.C. Berkeley in 1989 and an M.B.A. from Harvard Business School in 1994. Ms. Lam is well qualified to serve as a director due to her extensive experience serving on both private and public company boards, along with her financial, M&A and strategy experience.

|

|

Vote Required

The nominees who receive the greatest number of affirmative votes will be elected as Class II directors, to hold office until the 2025 Annual Meeting of Stockholders (or until the 2024 Annual Meeting of Stockholders if Proposal 2 is approved and the Declassification Amendment is filed and becomes effective as described in this proxy statement) and until their successors have been elected and qualified, subject, however, to any such director’s earlier death, resignation, retirement, disqualification or removal. Abstentions and broker non-votes will not affect the election of directors.

Holders of proxies solicited by this proxy statement will vote the proxies received by them as directed on the proxy card or, if no direction is given, then FOR the election of the nominees named in this proxy statement.

Recommendation of Our Board

Meeting)

| OUR BOARD UNANIMOUSLY RECOMMENDS THAT OUR STOCKHOLDERS VOTE “FOR” THE ELECTION OF THE CLASS II BOARD NOMINEES NAMED ABOVE.

|

Proposal 2: PROPoSED Amendment to OUR Certificate of Incorporation to Declassify OUR Board

General

Our Certificate of Incorporation currently provides for a classified Board divided into three classes of directors, with each class elected for three-year terms.

As part of our Board’s ongoing evaluation of our corporate governance practices and review of current corporate governance trends, the Board considered the advantages and disadvantages of Board declassification. After careful consideration, andOn June 8, 2022, upon the recommendation of the Nominating and Corporate Governance Committee, our Board, has determined that it is in the best interests of the Company and our stockholders overwhelmingly voted in favor to declassify ourthe Board. Our Board has unanimously approved, and recommends thatAccordingly, our stockholders approve at the Annual Meeting, the amendment to our Certificate of Incorporation attached to this proxy statement as Appendix A, which would

declassify the Board and provide for the annual election of directors over a two-year period (the “Declassification Amendment”).

Proposed Declassification Amendment

The Declassification Amendment to our Certificate of Incorporation would eliminate the classification of the board of directors over a two-year period beginning at the Annual Meeting, with the Class II directors to be elected pursuant to Proposal 1 serving two-year terms and the Class III directors to be elected at the 2023 Annual Meeting of Stockholders serving one-year terms and provide for the annual election of all directors beginning at the 2024 Annual Meeting of Stockholders. The three-year terms of the Class I directors elected at the 2021 Annual Meeting of Stockholders would not be affected by the proposed amendment. In addition, under the proposed amendment, at the 2024 Annual Meeting of Stockholders and at all future Annual Meetings of Stockholders, thereafter, a director elected to fill a vacancy or chosen to fill a position resulting from an increase in the number of directors would be elected for a term expiring at the next annual meeting of stockholders. Our Certificate of Incorporation currently provides that a director elected to fill a vacancy or chosen to fill a position resulting from an increase in the number of directors shall be elected for the remainder of the full term of the class of directors to which the new directorship was added or in which the vacancy occurred. In all cases, each director would serve until his or her successor is duly elected and qualified or until his or her earlier death, resignation or removal.

The Declassification Amendment also would provide that beginning with the 2024 Annual Meeting of Stockholders, directors may be removed with or without cause upon the affirmative vote of stockholders holding at least a majority of the voting power of all then outstanding shares of capital stock entitled to vote generally in the election of directors. Our Certificate of Incorporation currently provides that directors may be removed only for cause upon the affirmative vote of stockholders holding at least a majority of the voting power of all then outstanding shares of capital stock entitled to vote generally in the election of directors.

This description of the Declassification Amendment is qualified by the full text of the proposed amendment to our Certificate of Incorporation attached as Appendix A to this proxy statement.

Effectiveness of the Declassification Amendment

If this Proposal 2 is approved the Declassification Amendment would become effective upon the filing of the Certificate of Amendment with the Secretary of State of the State of Delaware, which the Company would file promptly following the Annual Meeting if our stockholders approve the amendment.

If our stockholders approve both this Proposal 2 and Proposal 3, the Company would file promptly following the Annual Meeting the Certificate of Amendment to our Certificate of Incorporation with the Secretary of State of the State of Delaware setting forth each of the proposed amendments to our Certificate of Incorporation from both this Proposal 2 and Proposal 3, which will become effective upon filing with the Secretary of State of the State of Delaware.

If this Proposal 2 is not approved, our board of directors will remain classified and the Class II directors elected pursuant to Proposal 1 will serve three-year terms expiring at the 2025 Annual Meeting of Stockholders.

Vote Required

Approval of the Declassification Amendment requires the affirmative vote of 66.7% in voting power of the outstanding shares of stock of the Company entitled to vote thereon, voting together as a single class. As a result, abstentions and broker non-votes will have the same effect as a vote AGAINST this proposal.

Holders of proxies solicited by this proxy statement will vote the proxies received by them as directed on the proxy card or, if no direction is given, then FOR the approval of the Declassification Amendment.

This Proposal 2 is separate from, and is not conditioned upon, the approval of Proposal 3 (Proposed Amendmentchanges to our Certificate of Incorporation to Eliminate the Supermajority Voting Standard). Your vote on Proposal 2 does not affect your vote on Proposal 3 and vice versa.

Recommendation of Our Board

|

|

| OUR BOARD UNANIMOUSLY RECOMMENDS THAT OUR STOCKHOLDERS VOTE “FOR” THE AMENDMENT TO OUR CERTIFICATE OF INCORPORATION OF THE COMPANY TO DECLASSIFY THE BOARD.

|

Proposal 3: PROPOSED AMENDMENT TO OUR CERTIFICATE OF INCORPORATION TO ELIMINATE THE SUPERMAJORITY VOTING STANDARD

General

Our Certificate of Incorporation currently provides that the affirmative vote of the holders of at least 66.7% of the voting power of all outstanding shares of capital stock of the Company entitled to vote generally in the election of directors, voting together as a single class (the “Supermajority Voting Standard”), shall be required to effect any amendment, alteration or repeal of Article V: Directors of our Certificate of Incorporation, which includes provisions related to the Board’s powers, size and vacancies and the election, term and removal of directors.

As part of our Board’s ongoing evaluation of our corporate governance practices and review of current corporate governance trends, the Board considered the advantages and disadvantages of eliminating the Supermajority Voting Standard. After careful consideration, and upon the recommendation of the Nominating and Corporate Governance Committee,declassify our Board has determined that it is in the best interestsand move to one-year terms, with such transition period ending this year. Our current term of the Companyoffice for our Class I, Class II and our stockholders to eliminate the Supermajority Voting Standard. Our Board has unanimously approved, and recommends that our stockholders approveClass III directors expires at the Annual Meeting, the amendment to our Certificate of Incorporation attached to this proxy statement as Appendix B, which would eliminate the Supermajority Voting Standard and instead provide for a majority voting standard (the “Elimination of the Supermajority Voting Standard Amendment”).

Proposed Elimination of the Supermajority Voting Standard Amendment

The Elimination of the Supermajority Voting Standard Amendment to our Certificate of Incorporation would eliminate the Supermajority Voting Standard and provide that the affirmative vote of the holders of at least a majority of the voting power of all outstanding shares of capital stock of the Company entitled to vote generally in the election of directors, voting together as a single class, shall be required to effect any amendment, alteration or repeal of Article V: Directors of our Certificate of Incorporation, which includes provisions related to the Board’s powers, size and vacancies and the election, term and removal of directors.

This description of the Elimination of the Supermajority Voting Standard Amendment is qualified by the full text of the proposed amendment to our Certificate of Incorporation attached as Appendix B to this proxy statement.

Effectiveness of the Elimination of the Supermajority Voting Standard Amendment

If this Proposal 3 is approved, the Elimination of the Supermajority Voting Standard Amendment would become effective upon the filing of the Certificate of Amendment with the Secretary of State of the State of Delaware, which the Company would file promptly following the Annual Meeting if our stockholders approve the amendment.

If our stockholders approve both this Proposal 3 and Proposal 2, the Company would file promptly following the Annual Meeting the Certificate of Amendment to our Certificate of Incorporationresult being that, beginning with the Secretary of State of the State of Delaware setting forth each of the proposed amendments to our Certificate of Incorporation from both this Proposal 3 and Proposal 2, which will become effective upon filing with the Secretary of State of the State of Delaware.

If this Proposal 3 is not approved, the Supermajority Voting Standard in our Certificate of Incorporation will remain unchanged and in effect.

Vote Required

Approval of the Elimination of the Supermajority Voting Standard Amendment requires the affirmative vote of 66.7% in voting power of the outstanding shares of stock of the Company entitled to vote thereon, voting together as a single class. As a result, abstentions and broker non-votes will have the same effect as a vote AGAINST this proposal.

Holders of proxies solicited by this proxy statement will vote the proxies received by them as directed on the proxy card or, if no direction is given, then FOR the approval of the Elimination of the Supermajority Voting Standard Amendment.

This Proposal 3 is separate from, and is not conditioned upon, the approval of Proposal 2 (Proposed Amendment to our Certificate of Incorporation to Declassify the Board). Your vote on Proposal 3 does not affect your vote on Proposal 2 and vice versa.

Recommendation of Our Board

| |

| OUR BOARD UNANIMOUSLY RECOMMENDS THAT OUR STOCKHOLDERS VOTE “FOR” THE PROPOSED AMENDMENT TO OUR CERTIFICATE OF INCORPORATION TO ELIMINATE THE SUPERMAJORITY VOTING STANDARD.

|

Proposal 4: APPROVAL OF, ON AN ADVISORY (NON-BINDING) BASIS, THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

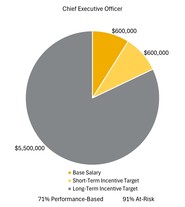

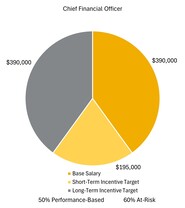

General